Procter & Gamble

Procter & Gamble (PG) is amongst the leading consumer goods companies globally. It came into existence in 1837. The company has presence in more than 180 countries today, serving around 5 billion people across the globe. The company is a leading house hold brand name owning more than 180 brands currently. Though Procter & Gamble products have a 60% share of US laundry market sales, they earn approximately 85% of the profit and cash generated in the category. Likewise, the company has a 70% share of blades and razors sales globally but a 90% share of the profit. Procter & Gamble has shown a strong growth trend in the past few years and has a history of increasing dividend payments to stockholders. I would recommend a buy for the stock, given its strong brand name, robust distribution network globally and its leadership position in the consumer goods segment.

Why P&G deserves to be in your portfolio

i) King of the Consumer Segment – P&G as a company, understands the needs of the common people and succeeds in converting them into potential consumer products. Today the company is a common name in each household across different countries. The company is an industry leader in terms of innovation. Procter & Gamble was the forerunner for the 2013 New Product Pacesetters list, since it launched 7 of the top 10 most successful non-food products of the year.

ii) Dividends – Procter & Gamble has a history of 58 years of consecutive dividend increases. The reason being that the company was able to grow its free cash flow by an annualized 10.3% every year since the last twenty years. That means that the investors were able to bag almost 800% in dividend pay outs, even though the total return from the company amounted to 500% for the same time frame. The current dividend yield is 2.8%.

iii) Multiple Billion Dollar Brands -The company owns 23 brands with annual sales of $1 billion to more than $10 billion, and 14 with sales of $500 million to $1 billion. P&G’s brands can be segmented into four broad categories:

- Beauty, Hair and Personal care – There are more than 30 brands under this segment. Leading ones like Pantene, Head & Shoulders, Wella, Olay, Hugo Boss, D&G etc.

- Baby, Feminine and Family care – 7 Brands for personal hygiene for the whole family

- Fabric and Home care – Leading brands like Tide, Ariel etc.

- Health & Grooming – Leading brands like Gillette, Oral B, Braun etc. Gillette has an 88% share of this segment.

iv) Focusing on core segments – Procter & Gamble is currently focusing on shedding off its stagnant brands and thus strengthening its portfolio of stronger revenue generating brands. The management is thus streamlining its business and wants to get rid of its 90 to 100 slow growing product lines. P&G has divested 28 brands to date. Most recent one being its exchange of Duracell business for Berkshire Hathaway’s P&G stock. The company now plans to sell its $ 7 billion Wella hair care brand too and is looking for a potential buyer. P&G recently sold two of its pet care brands – Iams and Eukanuba in Taiwan, Singapore, Malaysia and Brunei to Mars, Inc. P&G wants to be more focused on its other 80 strong brands like Tide and Pampers, which are the top revenue generating brands for the company. They generate nearly 90% of current P&G sales and more than 95% of current profit.

v) Market Expansion – Procter & Gamble is present globally. Almost 39% of its total sales were in North America, followed by 28% in Europe and 16% in Asia. Remaining 17% sales were in Latin America, India, Middle East and Africa. Approximately 39% of the net sales is from developing markets. There has been a rise in consumerism in the developing economies because of the steadily rising incomes and population in these markets. The company has innovation facilities in US, England, Switzerland, and Brussels. It recently announced innovation hubs in Beijing and Singapore.

vi) Annual Performance – The company scores strongly on all major financial parameters. It has a good cash flow, positive and expanding profit margins and decent debt levels. P&G recently gave its 2014 annual results. As can be seen from the picture below, there has been an increase in net sales, cash flow and EPS. The current debt-equity ratio is 0.50, which is below the industry average.

We met our business and financial objectives for fiscal year 2014. Organic sales grew 3%, in line with the market. Core earnings per share increased 5%. We generated $10.1 billion of free cash flow, with 86% free cash flow productivity. We increased the dividend 7% – the 58th consecutive year that P&G’s dividend has been increased – and we returned $12.9 billion in cash to shareowners through $6.9 billion in dividends and $6 billion in share repurchase – A.G. Lafley (Chairman of the Board, President and Chief Executive Officer).

Source: P&G

Risks

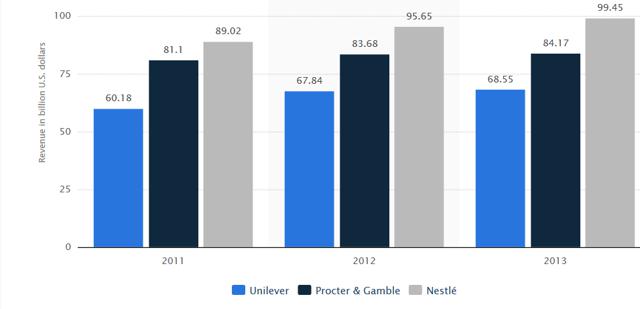

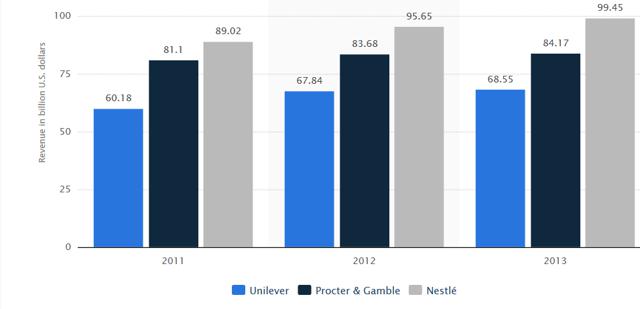

a) Competition – The company faces tough competition from other multinational consumer goods giants such as Unilever and Nestle. Even on a segment level, P&G faces competition. For example, its beauty segment faces competition from Estee Lauder Co., Loreal; home care from Colgate-Palmolive, Henkel, and Reckitt Benckiser etc. All these brands are also quite popular globally.

(click to enlarge)

Source: Statistica

b) Loss making Brands – Procter & Gamble owns several brands under its umbrella. Most of them are leading names in the industry, though some of them are slow growing and have become stagnant with time. The company is planning to shed off such brands to concentrate more on the strong revenue generating ones. This could be a limiting factor for the company as it will need to spend time or even cash (as in the latest Duracell deal) to find the buyers for such segments.

c) Cost Fluctuations – The company is directly affected by any changes in commodity prices, raw materials, labor costs, energy costs, pension and healthcare costs. Other factors to consider are foreign exchange and interest rates. P&G therefore needs to play the market forces well, in order to mitigate any effects of changes in the above parameters.

Stock Valuation

The P&G stock is currently trading at ~$90, which is very close to its 52 high price of $ 91.17. The company has a market capitalization of $ 245.2 billion with a P/B of 3.8x and P/S of 3.2x. In contrast the UL stock has a P/B of 7.5x and P/S of 2.1x, having a market cap of $ 127.8 billion. P&G (~7.37%) gave better returns than Unilever (~4.04%) in the last one year. The stock price has steadily risen in the last few years, moving in an upward trend since the mid of 2012 and reaching the peak high currently. The stock gave 44.17% returns in the last five years.

P&G 5 years stock price

Source: Google Finance

Conclusion

The annual average returns to shareholders of US listed consumer goods companies increased by 10% over the last 25 years. It outperformed not only the broader S&P 500 index but also IT, energy and telecom industries, which were fast growing during that time. One of the reasons for the fast growth in this segment is the emergence of consumerism especially in the emerging markets. P&G alone gave an astounding ~3464% returns since in 1978, when S&P returned ~2197%. P&G is a rock solid stock and can even form an integral part of one’s retirement plans too. With the company’s rich dividend pay outs, strong cash balance, management’s focus on streamlining the business and the consumer trust on its brands, it definitely deserves to be a part of your portfolio. However given the peak high prices it is now trading, I would advise investors to wait for a suitable entry point.