Sunrun Q2 2016 Results

Sunrun Inc (NASDAQ: RUN) installed 65 MW of solar panels in Q2 2016, exceeding its 60 MW target. The full year installation guidance stands in between 270-280 MW, which accounts for a growth of more than 35% from the installation numbers in the last year. This is even higher than that of SolarCity (NASDAQ: SCTY) and Vivint Solar (NYSE: VSLR). Revenues reported also increased to $122.5 million from $72.7 million a year earlier.

The company not only successfully achieved its targets, but also reduced its costs. Net income also increased four times from that reported in the last year, to more than $ 32 million. The NPV which is an important metric for residential installers, also more than doubled to 94 cents per watt, from 40 cents per watt in the earlier quarter. The company is working towards delivering NPV of above $1 per watt in the second half of the year.

Also read Booming Rooftop Solar Around the World!

I think it could be a good opportunity for Sunrun to shine, given the organisational and structural issues its top rivals are currently into. While Vivint Solar was a victim of a failed acquisition by SunEdison, SolarCity is subject to an acquisition by Tesla Motors. Sunrun has also consistently delivered on its promises and was successful in beating its own targets in its most recent quarter.

The stock is currently trading at ~$6, with a market capitalization value of $625 million. Compare this to SolarCity’s market value of $2.34 billion. I think RUN is highly undervalued, given the potential of rooftop solar in USA and also the company’s performance. Sunrun has definitely distinguished itself by exceeding its estimated installation numbers, at a time when residential solar players are having a hard time meeting their targets.

Though Sunrun’s creation cost was $3.67 per watt in the second quarter of 2016, compared to $4.11 in the first quarter of 2016, it is still high when compared to its peers. During the same SolarCity’s cost stood at $3.18, while for Vivint Solar it was $3.34 per watt.

“We are pleased with our performance in the second quarter as we continue to grow and create customer value in 2016. We believe we are well positioned to continue to build growth and customer value that will differentiate us as the leader in bringing local clean energy direct to consumers” – said Lynn Jurich, the CEO of Sunrun.

Source: Sunrun

Sunrun can leverage from the strong Solar market in USA

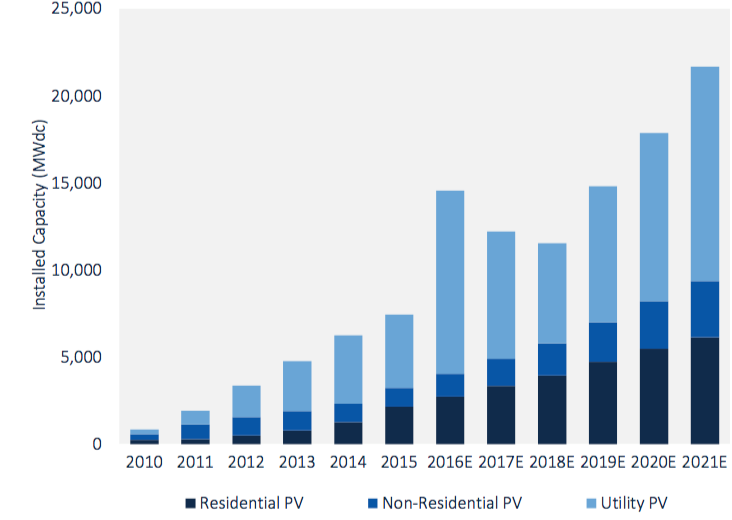

USA is a strong solar market and continues to support solar installations, as is evident from its important move of extending ITC. The residential solar market faced challenges in some states like Nevada, but the country still posted a fourth consecutive quarter with more than 500 MW of capacity brought online in Q1 2016. USA reached close to 30 GW mark of solar installations in the first quarter of 2016 itself, with solar accounting for 64% of new electric generating capacity. The residential solar installations will increase steadily over the years as can be seen from the graph below. Hence it is a good time for the residential players to expand their marketshare in USA. Sunrun, SolarCity and Vivint Solar are the leading solar players in this space. However they need to watch out for changes in net metering laws and competition arising from lending, when compared to leasing.

Source: GTM

Google+