First Solar Q2 2016 Results

First Solar (NASDAQ: FSLR) has been a key player in the solar thin film technology. In fact it is amongst the very few companies who is engaged in manufacturing thin film panels globally. Another prominent player in this technology is Japan’s Solar Frontier. First Solar recently announced its second quarter results for 2016, laying emphasis on improving technology and further improving efficiencies of its thin film modules.

The company successfully reached lead line module efficiency at 16.4%, and even lowered its module cost per watt further. Q2’16 was marked by increased sales and profits, due to higher module and project sales. The production also increased by ~40% in Q2’16, when compared to Q2’15. The potential booking opportunity stands at 24 GW, with Americas, Middle East and India being the largest markets. Over 1.4 GW of pipeline additions already done on a YTD basis.

Also read FSLR Q1’16 Results here.

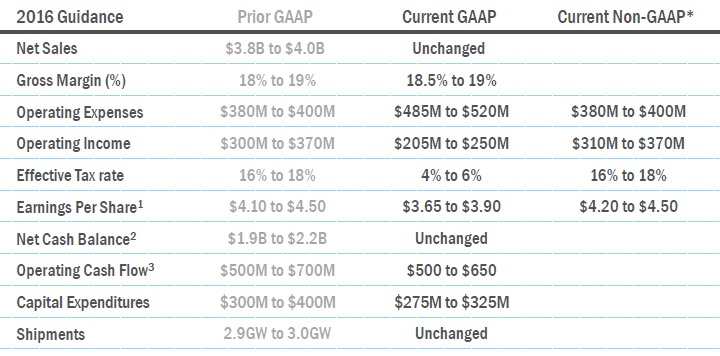

First Solar further revised its 2016 guidance, lowering its operating income and cash flow. The company’s profitability was affected due to the recognition of $86 million in restructuring charges during the quarter.

2016 Guidance

Further the company is planning to go ahead with its Series 5 (365-390W) and Series 6 (more than 400W) thin film modules, which is expected to increase its efficiency while reducing costs. As a result, First Solar will also end production of its TetraSun crystalline silicon solar panel product currently manufactured there in Malaysia. First Solar has been receiving sufficient efficiency level boost on the thin film front. This shows the conviction of the company in its technology and how effectively the company has made its thin film Cd-Te technology competitive with the mainstream silicon technology. The assembly line will be fully operational by early 2017.

“Over the past two years, execution of our CdTe technology roadmap has positioned the product as the industry leader for utility-scale solar, as well as established a promising path into the future. The Series 5 module, and the Series 6 module still in concept development, are game-changing products that position us for exciting growth. They require the full attention of our manufacturing operations,” said de Jong.

Source: First Solar

The company is also emphasizing on large scale solar projects and community solar. Approximately 121 MW of community solar projects have already been booked using thin film modules.

“This scale of community solar implementation is extraordinary, and suggests the enormous potential for this market segment,” commented Georges Antoun, First Solar’s Chief Commercial Officer.

Why is First Solar a Buy

First Solar has been quite successful in technology innovations, improving efficiencies and reducing costs. The company claims to attain 25 cents per watt levels by 2019. First Solar is a strong player in the solar industry and should benefit from the double digit growth of the solar industry. The company’s valuations have declined from the $5.5 billion level to $3.76 billion currently. The stock is currently trading at ~$39 level, which is nearly half if its 52 week high price.

Source: Google Finance

While I appreciate some correction in terms of valuation, I think the market has reacted quite strongly. In my opinion it is a good move by the company to improve on its quality by further introducing its Series 5 modules. The company could achieve a breakthrough especially in markets like India, where FSLR already has a good marketshare and its products are more acceptable. The company has shown competence in its executions and is also looking strong to meet its project completion target for the year. I think the stock took a toll due to a weak guidance for the full year, for which Mr. Market punished the stock. At this price, the stock is a steal in my view. I hence recommend a strong buy.

Google+