The stock market is trading at high valuations with S&P 500 touching new all-time highs and many top fund managers calling the market to be overvalued. Even the Fed governor called the market to be trading at overly high valuations. Picking stocks in this market has become harder as it is difficult to come across cheap stocks. Intel remains a good bet in this market, as its valuation is not aggressive and it has got a good downside support due to its dividend yield of 3%. The stock has increased by almost 50% in the last year, as it has managed to offset the decline in the PC industry through gains in its core server domain. Intel is looking to improve its growth prospects by trying to buy Altera, which would increase its TAM by targeting new segments such as industrial, automotive etc. Intel’s previous attempts at diversifying into new areas were not well thought of. Its’ On Cue service never made much sense to me given Intel’s strengths.

The company’s DNA is oriented towards the B2B enterprise technology segment like Cisco and Microsoft. These companies have generally failed in their attempts to enter the consumer product segments. Intel is better off leveraging its semiconductor design and manufacturing strength, rather than trying its hand in consumer technology. Intel has managed to become competitive in the mobile processor space through sheer muscle power. The company knows that it cannot afford to miss the mobile bus, as consumer technology is inevitably moving towards mobile from desktops. Smartphones are becoming more powerful by the day, with improving processing power and higher memory. Even as top semiconductor players such as Nvidia, Texas Instruments etc. have abandoned this segment, Intel has become a dominant player. I also think that the new management has also performed excellently by spending money and time on the right areas (new wearables focused segment, capturing marketshare in mobile processors). Given all of the above arguments I think that Intel stock remains a buy, given its ~3% dividend yield and 13x forward P/E.

Why I think Intel has got more legs

1) The Client Computing Division is a Cash Cow that will continue to generate billions in profits

Many critics have panned Intel because of the falling growth of its PC processor division. There is no doubt that the PC market is declining and Intel being the dominant player (with over 90% marketshare) is going to be hurt. But products cannot return revenues for perpetuity. They have to mature and decline at some point in their lifecycle. The important thing is that Intel has managed to grow new product lines, which are managing to compensate for the falling revenues in its bread and butter PC division. It has 3 star division, which are showing rapid growth and in which Intel has a large marketshare. Its server division and IOT division are growing in the double digits and are starts. The software and services division is more of a supporting group and not really a big value or growth driver on its own. The Client Computing Group has become a “Cash Cow” and Intel will be able to milk it for a long time. This segment is still generating over $7 billion in revenues at high margins. The company can use the cash flows to invest and grow new products and services.

Source – https://cowanglobal.wordpress.com/tag/cash-cows/

2) Cheaper than it’s “mega cap” technology peers

Intel is at par or cheaper than its other technology peers on most valuation metrics. It also has got the highest dividend yield at 3%. Intel has got a bigger technology moat in my view. It faces lesser competitive pressures than Apple and Microsoft. The company’s dominance in server and PC processors segment is unmatched. I have taken the growth estimates from Yahoo Finance and it is not my viewpoint on growth. I think the risks to growth are high for Cisco and Apple. It is just for reference to show how the investor community thinks about the future growth prospects. If you see the table below, Apple is an outlier with its growth prospects while others are more or less in the same range. Intel’s valuation is cheaper than all the other big tech stocks. I have not compared it to Google, Facebook, Alibaba and others because they are growing at a much faster pace and have more of a growth stock characteristic. I have also not put IBM which has shown a declining revenue trend for the last 12 quarters and is not a good comparable.

| Company | Forward P/E | P/S | P/B | Dividend yield | Growth (next 5 year) |

| Cisco | 13x | 3.2x | 2.6x | 2.6% | 9.4% |

| Intel | 13.5x | 3x | 2.9x | 3% | 8.25% |

| Microsoft | 16.7x | 4.2x | 4.3x | 2.46% | 7.38% |

| Apple | 13x | 3.6x | 5.8x | 1.48% | 13.2% |

Source – Morningstar, Yahoo

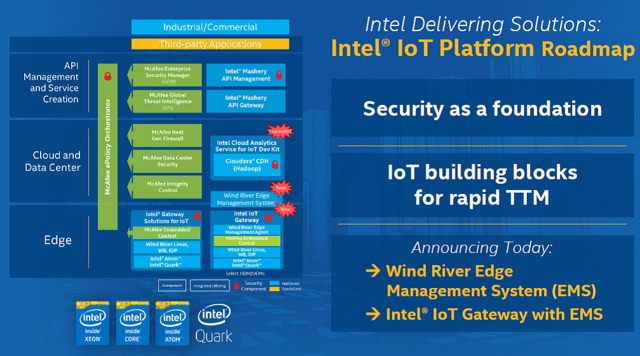

3) Rapid Growth in Internet of Things is almost certain

There is little doubt that Internet of Things (IOT) will be massive opportunity for technology companies. Intel has made some really smart moves to increase its share of the rapidly growing Internet of Things industry. One of the first moves made the new CEO Brian was to open a separate dedicated division for the wearables and IOT technology. Intel did not want to miss the bus on IOT, like it did with mobile processors. The last Intel CEO publicly admitted his huge mistake of not supplying Apple with a mobile processor and missing on the smartphone revolution. The company is partnering with top companies such as IBM, Accenture, Cisco and others to build a complete solution for customers looking to improve product/service offerings and decrease costs. The company has launched new processors (Spark) to specifically target this low power, low cost segment. Results are already proving, with the IOT segment showing the most rapid growth amongst all other segments. Intel has developed all the pieces such as processors, software, services and security around its IOT platform. The division generated $533 million and showed a year on year growth of 10%.

Source – Intel

4) Is being smart by focusing on growing in the semiconductor area even if it loses money in the short term

Intel’s DNA is in semiconductor design and manufacturing where it has been a dominant player over the last 30 years, despite the massive changes. The company has experience and a deep understanding of enterprise technology space. Getting into consumer technology makes little sense and won’t move the needle for its financial numbers. I think it was a good move for Intel to spend billions of dollars in research, manufacturing and marketing to gain a dominant position in the mobile processor space. The company could not afford to lose in the mobile processor area, as it would have threatened its PC processor segment. ARM based processors are already being used to power tablets and PCs. Intel has lost a lot of money to ensure that its x86 architecture capture a large marketshare of the low end tablet processor market. It has also spent a great deal of money in developing a good communication product to compete better with Qualcomm. While some people might criticize Intel for spending too much money on Altera, I think that it is a good move. The company generates over $10 billion of free cash flow each year. Spending it on buying a dominant player in the FPGA space is not a bad idea. It will give Intel access to new products and markets, besides increasing the utilization of its fabs.

5) Bleeding in Mobile Processors to stop after 40 million tablet target achieved

Intel went all out in 2014 to capture marketshare in the tablet processor segment, losing billions as it gave huge subsidies to tablet manufacturers to use Intel’s chips. After gaining a strong foothold and building a decent foundation, Intel is now going to stop giving subsidies. It will focus more on profitability and absorb the mobile processor division into its Client Computing Group. The company is partnering with low cost Chinese players to target the lower end of the processor chip market. Some people might criticize Intel for losing so much money, but I think it was a critical defensive move.

Going forward, “our key goal for mobility is to improve profitability,” he said, adding that he expects unit growth in the tablet space will keep pace with the market. “We don’t need to go out and necessarily outpace the market or anything like that this year from a growth perspective,” the CEO said, noting that the goals are to cut costs and increase efficiencies. “We’ll grow at the rate that the market does. I don’t think I want to necessarily shrink, so unless the market shrinks significantly, I think we would then probably try and target more of a flattish [growth rate].”

Source – Eweek

Stock Performance and Valuation

Intel’s stock has outperformed the stock market and NASDAQ in the last one year. The stock is trading in the $30-37 range after breaking out of its $20 levels last year. The company is cheap in my view with a P/E of ~13.8x and a divided yield of 2.7%. I think that Intel’s downside is capped, as the company has formidable technological strengths in manufacturing technology as well as R&D. The company is getting traction in the Internet of Things segment and will continue to dominate server and PC processors. Altera acquisition might open a new revenue growth stream for the company.

Summary

Intel has performed quite well in the last one year, with sharp growth seen in its server and IOT divisions. Though the PC processor division is continuing to decline, this division will continue to generate billions of dollars in operating cash flow over the medium term. Intel has also spent huge amounts of money in order to become more competitive in the mobile processor space. Though it has not been able to get a break into supplying processors to Samsung and Apple mobile devices in a meaningful way yet, it has increased its marketshare with other customers (e.g. Asus). Intel has managed to maintain high gross margins (60% plus) as it has a massive technology lead in the server processor area. Server processors based on ARM designs have failed to get traction, despite the strong efforts being made by the like of AMD and others. Intel’s valuation is still cheap and it gives a nice dividend yield. The technology moat around Intel is extremely strong and it has good chance of growing in new areas such as 3D NAND and FPGAs (if it succeeds with Altera acquisition). I would advise investors to continue buying Intel on dips.

Google+