Apple (AAPL) has been criticized as being too slow in rolling out new products as compared to important rivals such as Samsung

(SSNGY.OB), Blackberry (BBRY), LG and even Nokia (NOK). Apple’s latest version of iPhone is already a year old and the date for the new version has not been announced. Meanwhile Samsung is claiming to have sold 10 million units of its Galaxy 4 smartphones since its launch on April 26, 2013. Blackberry has also been reporting good shipments of its latest BB 10 flagships – Z10 and Q10. Nokia has managed to increase the sales of its Lumia smartphones by 27% in the previous quarter and will increase its Lumia sales by the same rate in the coming quarters.

The deluge of positively spun media news about competitor flagships had led to a severe decline in Apple’s stock price. However, I remain optimistic about Apple’s stock, given the current valuation and all round strengths of the Apple ecosystem. iPhone is the most important product for Apple, accounting for more than 50% of its revenues and gives a better margin than the overall corporate margin. The recent pessimistic news on the iPhone does not give the real picture. Data points indicate that iPhone is gaining market share in crucial mobile markets such as India and USA. The customer satisfaction with iPhone remains very high and new iPhone introductions should boost shipments in the latter half of 2013.

iPhone is the bedrock of Apple’s current Business model

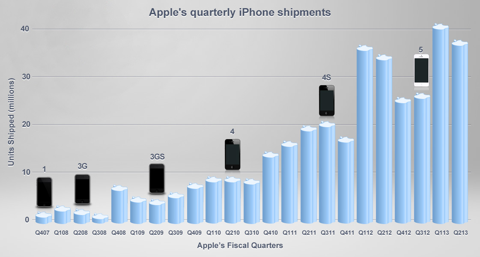

While Apple sells billions of dollars of iPads, iPods and iMacs, the iPhone remains the principal contributor to Apple’s profits and revenues. The company sold 37.4 million iPhone units during the last quarter with total revenues of $23 billion. This comprised more than 50% of Apple’s total net sales and the percentage should remain in this range for the next couple of years. The iPhone gross margin is also rumored to be much higher than the overall corporate margin of 37.4%.

iPhone is increasing its already large market share in Japan and USA

The main reason for the lower growth rate of iPhones is the absence of a cheaper iPhone in Apple’s smartphone lineup. Samsung has managed to capture a large market share in the middle and lower end segments of the smartphone industry due to a lack of strong competitive products. Despite this handicap, iPhone is increasing its marketshare in crucial markets like Japan and USA. Apple management said that the iPhone had increased its market share in USA and Japan.

Based on research published earlier this month by comScore, iPhones garnered the number one spot in the U.S. smartphone market for the three-month period ended in February with 39% share, up from 35% in the previous survey period. And in Japan, IDC Japan announced that iPhone gained the number one position for all of calendar year 2012 as well as for calendar Q4 2012 in both handsets and smartphones. This is also the first time a non-Japanese company has achieved the number one spot for an entire year.

iPhone beats others by a huge margin in Customer Satisfaction

Apple has very high customer satisfaction numbers due to the tight integration of its hardware and software. The company never compromises on the quality of its products which allows it to charge a substantial premium over its competitors. Samsung sells a wide variety of phones, many of which are found wanting by customers. Unlike Samsung, Apple sells only 4 versions of the iPhone and keeps a very tight check on quality and performance. This allows Apple to get high scores from customers.

A recent study by Kantar measured 95% loyalty rate among iPhone owners, substantially higher than the competition, and iPhone remains top in customer experience. Last month, we were very pleased to receive the number one ranking in smartphone customer satisfaction from J.D. Power and Associates for the ninth consecutive time. The most recent survey published by Change Wave indicated a 96% satisfaction rate among iPad customers.

In India, iPhone sales are up by ~400% in the last few months

Apple has managed to become the No.2 smartphone seller in India during Q412. Using innovative financing and marketing schemes,  Apple has forced competitors on the back foot. Blackberry has been forced to come up with an EMI scheme as well as a cheap data plan to stem further marketshare losses. Samsung has also been compelled to start a 15% cashback offer and cheap financing schemes. An Economic Times article cites a Credit Suisse report saying that iPhone sales have increased by 300-400% in the last few months. According to the report, 400,000 iPhone units are being sold each month which would give Apple a ~20% market share in India in terms of volumes. Readers should note that exact figures in India are hard to get given the relatively unorganized nature of the distribution networks. However, even if you could argue about the percentage increase in shipments, there is no doubt that Apple is increasing marketshare in India.

Apple has forced competitors on the back foot. Blackberry has been forced to come up with an EMI scheme as well as a cheap data plan to stem further marketshare losses. Samsung has also been compelled to start a 15% cashback offer and cheap financing schemes. An Economic Times article cites a Credit Suisse report saying that iPhone sales have increased by 300-400% in the last few months. According to the report, 400,000 iPhone units are being sold each month which would give Apple a ~20% market share in India in terms of volumes. Readers should note that exact figures in India are hard to get given the relatively unorganized nature of the distribution networks. However, even if you could argue about the percentage increase in shipments, there is no doubt that Apple is increasing marketshare in India.

Compared to average monthly sales of 70,000-80,000 smartphones before the EMI schemes were offered to consumers in India iPhone sales have zoomed up to stratospheric levels, analysts at Credit Suisse said. “From our channel checks we believe that iPhone sales are nearing 400,000 units per month in India – that is nearly 3% share of handset sales for a single top-end product in a market that has long been dominated by low-end feature phones,” Credit Suisse’s research analyst Sunil Tirumalai said in a note to clients that was accessed by ET.

20 million iPhone units a month can be shipped in the 2nd half of 2013

Apple is currently selling iPhone at the rate of ~12 million units a month. According to DigiTimes, the Apple supply chain is being prepped up to ship 20 million iPhone units in the 2nd half of 2013. The report indicates that 2 new iPhones will be shipped. One of those could be a cheaper iPhone model and the other one should be a successor to the iPhone 5.

Apple reportedly plans to launch two models of its iPhone family in the third quarter of 2013 and has asked makers in the supply chain to prepare production capacity for 20 million units a month, according to industry sources in Taiwan. The two new iPhones, to be unveiled in June at the earliest, will include a revised version of the iPhone 5 and another low-cost iPhone model, which will be comparable to the iPhone 4S in hardware specifications but with a lower specification display and processor, the sources indicated.

Source : FierceMobile

Valuation and Stock Performance

Apple’s stock has stabilized at the $450 level in recent months after falling below $400. The biggest share buyback in history and the increased dividend yield has brought some relief to Apple’s stock. The stock remains subdued as there is no news of new product launches even as rivals such as Samsung continue to introduce new flagship products. Apple’s stock is cheap with a forward P/E of just 9.6x and a dividend yield of ~2.5%. The stock is even cheaper when you exclude Apple’s cash from its market valuation.

Summary

The constant new stories about new smartphones and gadgets have somewhat obscured iPhone strengths. The increased shipments in India, USA and Japan contradict the myth that Samsung is decimating Apple in the smartphone market. Most of Samsung’s gains have come in the lower and middle segments of the smartphone market, where Apple and Blackberry do not have any major products. Faster product launches by competitors does not mean that Apple is getting beaten, as iPhone 5 continues to be the largest selling smartphone in the world. I would look to build a position in Apple stock ahead of its new product launches in the summer season.

Google+