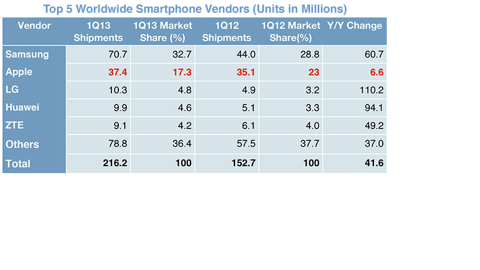

Samsung (SSNGY.OB) is the world’s largest seller of mobile phones having overtaken Nokia (NOK) in the last couple of years. More importantly, Samsung has also become the No.1 seller of high margin smartphones, pushing erstwhile Western leaders such as Blackberry (BBRY) and Nokia to the margins. In fact, Nokia and BBRY do not show up in the top 5 smartphone rankings for Q113. Even Apple (AAPL) is facing the heat as it lost market share during Q113, despite the iPhone selling ~37 million units.

The other Korean giant LG (LGEIY.OB) has also made impressive gains during Q113 as its “Optimus” line of smartphones has received great reviews. Both BBRY and Nokia are currently undergoing painful transitions as they look to completely revamp their overall strategy. While BBRY is already on way to a decent recovery through its new BB 10 products, Nokia is also fighting hard with its new Windows Lumia range of smartphones. However, Samsung and LG continue to innovate at a breathtaking pace and it will be hard for the western mobile manufacturers to regain their leadership position in the mobile devices space. The stock market has crushed Western mobile stocks as they have lost out to the Korean companies. The smartphone market continues to grow rapidly, despite its already large size of ~700 million units. This means that the mobile devices market can accommodate a number of companies.

Source – IDC

Samsung Strengths

Samsung is a unique mobile phone maker due to its vertical integration. Samsung not only designs the processors but also manufactures them at its own fabs. While Apple also designs its own “A” chips based on ARM (ARMH) designs, Apple uses Samsung to produce those chips. Samsung is also the largest memory producer in the world which means the company can meet most of its smartphone memory requirements from its in-house supply. Samsung is one of the biggest display producers which again gives it an edge over its competitors. Samsung’s Galaxy 3 was a big success because of its “AMOLED” screen. This Korean chaebol has a significant patent portfolio and a large number of mobile phone products which targets almost every segment of the mobile market. Samsung also has got one the best global marketing network in the industry.

Samsung not only launches a prodigious number of mobile products every quarte,r but is also at the forefront of technology development. The company recently announced a roadmap for “5G network” with super fast data speeds. The company is also set to introduce the new version of its Note “phablet” – Galaxy Note 3. The new Note will comfortably beat the competition in terms of hardware and display size.

Samsung might use a 6.0-inch display for the Galaxy Note III, its forthcoming phablet which is expected to launch in a few months, a new report indicates. Also, contrary to some rumours the display is not likely to be a flexible AMOLED panel. The Samsung Galaxy Note III is expected to be powered by an Exynos 5 Octa-core processor, Mali 450 GPU with 8 cores and 3 GB of RAM. It’s also rumoured to feature a 13-megapixel rear camera.

Samsung has also reacted quickly to the competitive pressures as well as fast changing consumer preferences. It recently launched super size phablets to meet consumer preference for larger screen sizes. The company has also launched the cheapest Galaxy smartphone to compete with Nokia’s higher end Asha phones in the emerging markets. The rate of new product introductions by Samsung has been quite breathtaking.

LG Strengths

LG the other big South Korean electronics giant does not have Samsung’s huge market share in the smartphone market. But, it is still a significant smartphone player and its Optimus products can beat the best in the market, in terms of looks and performance. The company’s market share has been going up rapidly as it concentrates more on the higher end of the mobile devices market. LG managed to beat Huawei to the No.3 spot in the smartphone market by shipping over 10 million smart phones during Q113. LG showed the biggest percentage increase in smart phone marketshare amongst the top 5 players. LG like Samsung has a huge global marketing network which it has leveraged to become a top smartphone seller.

LG also managed to rope in Google (GOOG) to become the seller of the blockbuster Nexus 4 smartphone. This smartphone is one of the best Android phones and comes at a very cheap price of just $299 for the 8 GB model. LG is building on the success of the black Nexus 4 by releasing a white version of the Nexus 4. LG might also look to sell a new upgraded Nexus 5 in collaboration with Google.

Will the Western players overcome the Korean Dominance

The global mobile device market is a massive one and continues to grow very strongly. Annual tablet shipments should exceed 200 million units in 2013, while smartphones should reach more than 900 million units. While Samsung and LG have managed to increase their market share, the leadership can change pretty quickly. Apple managed to completely change the mobile industry through its iconic iPhone relegating Nokia and Blackberry to the margins. Samsung will have a tough time in retaining its No.1 position, given the stiff competition from Western manufacturers as well as Chinese companies such as Huawei and ZTE. Nokia and BBRY have a very small smartphone marketshare and I think that they will manage to increase it. Apple’s iPhone continues to be the biggest selling technology product ever. Though Apple has lost some market share in the recent quarters, it is also extremely capable of regaining the lost market share though the introduction of a cheaper iPhone.

Also Read on GWI The Chinese rise in Smartphones continue Unabated.

Stock Valuation of Western mobile companies

As I have said earlier, all the major western mobile manufacturers are trading at low valuations because of the strong competition in the market. BBRY and Nokia are extremely cheap given their assets and potential to become an acquisition target. While Apple has climbed by ~15% since reporting its Q113 quarterly results, the stock remains undervalued with a P/E of below 10x. BBRY trades below book value with a P/B of 0.9x, while Nokia trades at a P/B of just 1.4x.

Summary

Both Samsung and LG have performed extremely well taking advantage of the weaknesses of the Western manufacturers. While BBRY and Nokia are busy in making radical changes to their corporate strategy, Apple has been hampered by the loss of Steve Jobs. However, the technology industry is a dynamic one and the positions can reverse in a very short time. All the three western manufacturers have the capability and products to displace the Koreans from their leading position. Apple has been hammered as it does not have a big enough smartphone portfolio. However, a cheaper iPhone could capture a large chunk of marketshare from Samsung’s lower and mid range smartphone segments. Despite the current Korean dominance, I remain optimistic that the western manufacturers will increase their smartphone marketshare. Given the depressed valuations, I would not hesitate in buying the stocks of these companies.

Google+